UPDATE FEBRUARY 2021

Originally planned for October 2019, the domestic reverse charge for construction services will come in next month.

There is also an amendment to the original legislation to make it a requirement that, where businesses are to be excluded from the reverse charge (because they are either end users or intermediary suppliers), they must inform their sub-contractors in writing that they are end users or intermediary suppliers. This is to ensure both parties are clear whether the supply is excluded from the reverse charge.

For reverse charge purposes an end user is a business which is the final customer who does not make onward supplies of the building and construction services supplied to them. Intermediary suppliers are VAT/CIS registered businesses that are connected or linked to an end user and who buy construction services and re-supply to a connected or linked end user without majorly altering the supplies.

INTRODUCTION

With effect from 1 March 2021, the way in which certain supplies of construction services are treated for VAT will change.

The new regulations introduce a “Construction Services Domestic Reverse Charge” (CSDRC) which requires the customer to account for VAT on supplies within its scope, rather than the supplier. Similar provisions are already in place in other industries in order to combat tax fraud.

The new provisions do not affect the VAT liability of supplies and so do not impact on VAT recovery. However, since customers pay VAT directly to HMRC rather than the supplier collecting it, suppliers need to consider the impact on their cash flow.

The CSDRC applies to supplies of construction services, as defined below, between VAT registered businesses where the recipient makes an onward supply of those construction services. Where the customer is the end user, the CSDRC is not in point.

The definition of construction services for the purpose of the CSDRC is aligned with that applicable to the “Construction Industry Scheme” (CIS). Supplies which are not within the CIS do not fall within the CSDRC. It is important to note that where there is an ancillary supply of goods with construction services, constituting a single supply, the entire supply is subject to CSDRC; goods are not reported for CIS purposes even if supplied with services.

Definitions given in the legislation of “construction services” and “excluded services” can be summarised as follows:

SERVICES AFFECTED BY THE DOMESTIC REVERSE CHARGE

- Construction, extension, demolition or dismantling, alteration or repair of buildings, structures, or of any works forming part of the land;

- Installation in any building of a heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection system;

- Internal cleaning of buildings and structures (so far as carried out in the course of their construction, extension, repair, alteration or restoration);

- Painting or decorating the internal or external surfaces of any building or structure;

- Services which form an integral part of, or are preparatory to, or are for rendering complete, any of the services described above.

SERVICES EXCLUDED FROM THE DOMESTIC REVERSE CHARGE

- Manufacture of components for systems of heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection;

- Manufacture of building or engineering components or equipment, materials, plant or machinery, or delivery of any of these things to site;

- Professional services of architects or surveyors, building consultants etc.;

- Installation of seating, blinds and shutters;

- Drilling for, or extraction or, oil or natural gas;

- Extraction of minerals and tunnelling or boring, or construction of underground works;

- The making, installation and repair of artistic works, sculptures, murals etc.;

- Signwriting and erecting, installing and repairing signboards and advertisements;

- Installation of security systems, including burglar alarms, closed circuit television and public address systems.

SUPPLIES OF CONSTRUCTION SERVICES WHICH ARE NOT AFFECTED BY THE CSDRC

The following fall outside the scope of the scheme:

- Supplies of construction services directly to the end user, such as a private individual or a business constructing a building for its own use;

- Supplies made by landlords to tenants (or vice versa);

- Supplies where the recipient’s onward supply is to a connected company;

- Zero-rated supplies;

- Services provided to a person who is neither registered nor required to be registered for VAT.

There is also a monthly ‘de minimis’ threshold of £1,000 below which supplies to a particular customer which would otherwise be within the CSDRC are disregarded.

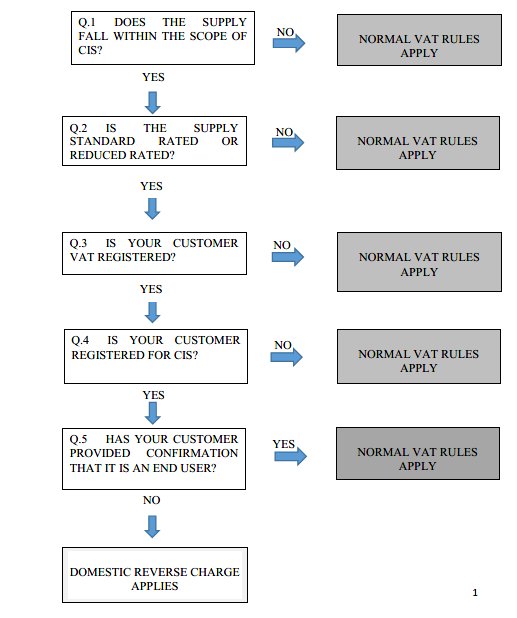

HMRC has published the following flow chart to assist with determining whether the CSDRC rules apply:

PRACTICAL CONSIDERATIONS

As with other ‘reverse charge’ arrangements, the customer accounts for VAT as if it were their output whilst simultaneously dealing with the input in the normal way.

Suppliers are required to indicate on their VAT invoices supplies which are subject to the CSDRC. The invoice must show the value of the supply, the applicable VAT rate and the amount of VAT due from the customer to HMRC, shown separately from the amount due from the customer to the supplier.

Importantly, as it is the customer’s responsibility to account for and pay the VAT to HMRC, the customer must verify that the VAT due shown on the supplier’s invoice has been correctly calculated since they are liable to HMRC for any under-declaration.

The value of CSDRC services does not count towards the recipient’s VAT registration threshold. Instead, as noted in the flowchart above, normal VAT rules apply and such customers are charged VAT by the supplier.

When applying the reverse charge, suppliers must obtain satisfactory evidence from customers that the customer is not an end user. Conversely, customers should ensure that a supplier does not incorrectly charge VAT on supplies that ought to fall within the scheme since incorrectly charged VAT cannot be recovered from HMRC.

For mixed supplies (that is those which constitute a single supply as a whole having some elements falling within the definition of construction services and some elements which do not) the CSDRC applies to the entire supply.

The information contained in this document is for information only. It is not a substitute for taking professional advice. In no event will Dixon Wilson accept liability to any person for any decision made or action taken in reliance on information contained in this document or from any linked website.

This firm is not authorised under the Financial Services and Markets Act 2000 but we are able in certain circumstances to offer a limited range of investment services to clients because we are members of the Institute of Chartered Accountants in England and Wales. We can provide these investment services if they are an incidental part of the professional services we have been engaged to provide.

The services described in this document may include investment services of this kind.